What Are CPG Goods? Categories Of CPG Goods

Ever wonder why toothpaste, chips, and paper towels are always placed at the front of the store?

These are what retailers call CPG goods. They are products people buy frequently, use quickly, and replace often.

Consumer packaged goods are a constant part of daily life, from your morning coffee to your evening snacks.

But what exactly are CPG goods? And how do companies categorize them to better manage sales, marketing, and logistics?

This guide breaks it all down, starting with a clear definition and moving into the main categories that shape the global CPG market.

What Are Consumer Packaged Goods?

Consumer packaged goods (CPG) are low-cost items that people use daily and replace frequently. These include everyday staples like snacks, beverages, cleaning products, toiletries, and over-the-counter medicines.

The term “packaged” refers to how these items are sold: pre-wrapped, shelf-ready, and designed for quick use or consumption. Think cereal boxes, shampoo bottles, or detergent containers.

In short, CPG products are built for volume and speed. They move fast through retail shelves and are the backbone of strategies in supply chain management, promotions, and customer experience.

If you're comparing terms:

-

FMCG vs CPG: They refer to the same product class.

-

“Fast-moving consumer goods (FMCG)” is used globally.

-

“Consumer packaged goods (CPG)” is more common in the U.S.

Cpg Industry Overview

The CPG industry includes all the packaged items consumers use on a regular basis. These are products that are bought often, replaced quickly, and priced for accessibility.

It’s a competitive, high-volume sector driven by consumer habits, retail channel shifts, and rapid product innovation.

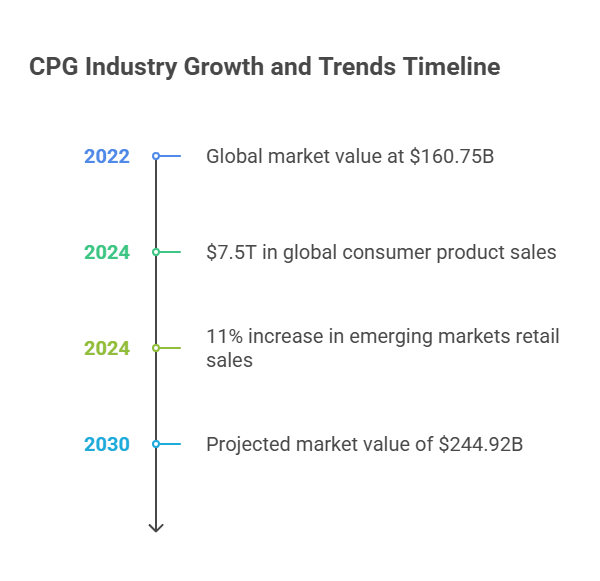

Market size highlights:

-

$160.75B global market value in 2022, projected to reach $244.92B by 2030

-

$7.5T in global consumer product sales in 2024, up 7.5% year-over-year

-

Online CPG sales grew 10% last year, outpacing brick-and-mortar

-

Emerging markets saw an 11% increase in retail sales in 2024

Current trends shaping the industry:

-

Omnichannel buying habits are becoming the norm

-

Health, sustainability, and personalized products are in demand

-

CPG brands are investing in DTC channels

-

Supply chain innovation and automation are key for scaling

If you need a reliable way to collect e-commerce data at scale, try Unwrangle.

It helps you extract product listings, prices, and reviews from major retail sites while handling rotating IPs, site changes, and pagination. Use it to streamline competitive analysis, price tracking, and review sentiment workflows without building or maintaining scrapers.

Top global players include:

-

Nestle

-

Procter & Gamble

-

PepsiCo

-

Unilever

-

Coca-Cola

CPG Product Categories

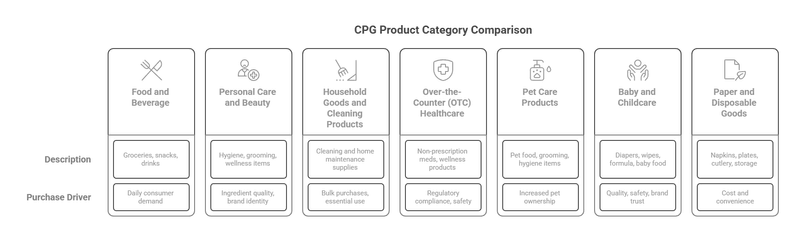

Consumer packaged goods span a wide range of everyday items, but most can be grouped into a few core categories based on their function, use frequency, and shelf placement. Understanding these categories helps companies tailor their manufacturing, marketing, and supply chain strategies.

1. Food and Beverage

This is the largest and most diverse CPG segment. It includes shelf-stable groceries like cereal, canned soup, and pasta, as well as refrigerated and frozen items such as dairy products, frozen meals, and beverages. Snack foods, coffee, bottled water, and juices also fall under this category. Products are typically high-turnover and require consistent restocking due to daily consumer demand.

2. Personal Care and Beauty

These products support daily hygiene, grooming, and wellness routines. Common examples include toothpaste, shampoo, deodorant, shaving products, skincare, cosmetics, and hair care. Many personal care brands compete on attributes such as ingredient quality, scent, and brand identity, making packaging and placement especially important.

3. Household Goods and Cleaning Products

Items in this group are designed for cleaning, maintenance, and home upkeep. This includes paper towels, toilet paper, laundry detergent, dish soap, disinfectant sprays, and air fresheners. These products are often bought in bulk and are essential to both residential and commercial consumers.

4. Over-the-Counter (OTC) Healthcare

This category covers non-prescription medications and wellness products such as pain relievers, cold and flu remedies, allergy medicine, vitamins, and supplements. Retail compliance and product labeling are crucial due to regulatory requirements and safety considerations.

5. Pet Care Products

Pet food, treats, grooming supplies, and hygiene products like litter and waste bags are included in this growing category. Increased pet ownership and consumer interest in premium pet care have made this a fast-expanding segment within CPG.

6. Baby and Childcare

These products cater to parents and caregivers and include diapers, baby wipes, formula, and baby food. Quality, safety, and brand trust are major purchase drivers, often making consumers highly loyal once they find a brand that works for them.

7. Paper and Disposable Goods

This includes napkins, tissues, disposable plates, plastic cutlery, and food storage products. These items often prioritize cost and convenience and are typically purchased in multipacks or bulk formats.

CPG Data Analytics and Consumer Insights

The CPG space moves fast. Brands need to know what people want, when they want it, and how they shop. That’s where real-time data becomes essential. From tracking trends to optimizing promotions, staying ahead of demand starts with better visibility.

1. Smarter CPG Market Research

Old research methods are too slow. Instead of waiting on surveys or reports, teams now pull live retail data. Tracking online listings, price shifts, and review sentiment gives immediate insight into market activity.

It’s a faster way to test positioning, monitor competitors, or uncover gaps in product assortment

2. Real-World Consumer Data

CPG brands now rely on real shopping behavior. They analyze what customers add to carts, which products get repeat purchases, and how buyers describe them in reviews.

Everything from star ratings to phrasing in feedback helps inform product design, messaging, and offers.

3. Smarter Tools for Insights

New tools scan thousands of reviews, detect trends, and cluster similar mentions. This helps brands understand preferences, spot ingredient concerns, and respond to packaging feedback before the competition.

It’s especially useful in saturated categories like personal care, snacks, or supplements.

4. Predictive Analytics for Planning

More brands use predictive models to forecast demand. These models factor in past sales, seasonality, and launch patterns to help teams plan ahead.

Backed by current ecommerce data, forecasts become more accurate, helping reduce stockouts and wasted spend.

5. Spotting Buying Patterns

Analyzing purchase behavior shows how often and when people buy. If shoppers reorder a product every 30 days, that insight supports subscription options or scheduled campaigns.

It also highlights early spikes, like seasonal demand kicking off in certain regions, giving teams time to adjust.

Looking to power your analytics with fresh, structured retail data?

Unwrangle Ecommerce Data API helps CPG brands collect real-time product listings, prices, and review insights across retail sites, without managing scrapers or worrying about blocked requests. Use it to move faster, dig deeper, and respond smarter.

Final Word

Winning in the CPG space today means knowing your customers better and moving faster than the competition. Internal dashboards are not enough. You need real-time visibility into pricing shifts, product availability, review sentiment, and shopper behavior across every channel.

If you need flexible access to e-commerce data for market tracking, predictive analytics, or consumer insights, Unwrangle provides the APIs to support those workflows.

Here are a few guides to help you get started: