Procurement Market Intelligence: Tools, Data, and Use Cases

What would you do if you had to source materials in a volatile market?

You would want:

-

Real-time insights into pricing trends

-

A clear view of supplier risks and performance

-

Data to back strategic sourcing and negotiation decisions

That is exactly what procurement teams need in today’s high-pressure environment.

From inflation and geopolitical instability to unpredictable supply chains and evolving ESG demands, procurement leaders are expected to cut costs, mitigate risks, and deliver value all at once.

This is where Procurement Market Intelligence becomes essential.

It transforms procurement from a transactional function into a strategic force, moving from reactive fire-fighting to informed, forward-looking decision-making.

In this guide, we will cover:

-

What procurement market intelligence really means

-

Key data sources and types of insights to prioritize

-

How leading teams use market intelligence to drive results

Let’s get started.

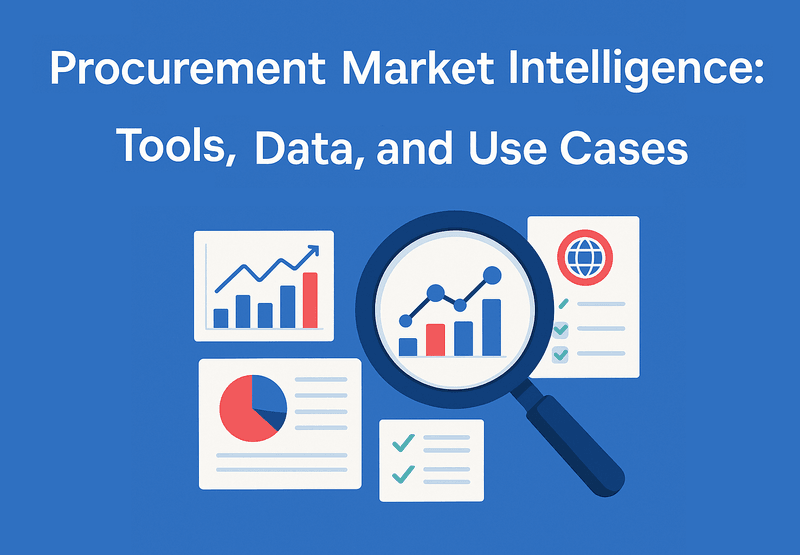

What Is Procurement Market Intelligence?

Procurement market intelligence is the process of collecting, analyzing, and applying market data to improve sourcing decisions.

It includes information such as:

-

Real-time pricing trends

-

Supplier performance and risk profiles

-

Category cost drivers and innovation signals

-

Benchmarking data and competitor insights

-

Regulatory and sustainability updates

Traditionally, procurement relied on internal sources such as ERP data, contract terms, historical spend. But market intelligence brings external awareness to that foundation. It answers questions like:

-

Are suppliers raising prices in the open market?

-

Are stockouts increasing in a particular region?

-

Are new suppliers entering the space with better terms?

-

Which specs or SKUs are being phased out?

This kind of intelligence isn’t typically available in dashboards or reports. It has to be gathered from the web, from public sources, from dynamic catalogs and product feeds. And increasingly, teams are turning to scraping tools and APIs to automate this process.

What Procurement Market Intelligence Actually Includes

Market intelligence covers multiple dimensions:

| Intelligence Type | Description | Examples |

|---|---|---|

| Supplier Intelligence | Data on vendor capabilities, financial health, and lead times | Credit reports, on-time delivery metrics, and SKU availability |

| Category Intelligence | Pricing trends, material availability, and cost drivers | Commodity indexes, substitute materials |

| Geopolitical/Regulatory | Risk from local laws, trade policies, or conflicts | Tariffs, labor laws, export restrictions |

| Competitive Insights | Clues about competitors' sourcing strategies | Shipping data, public contracts, UPC tracking, retail catalog benchmarking (Check out our Home Depot API and Lowe’s API) |

How to Collect Procurement Market Intelligence (With and Without Tools)

Manual Methods

-

Public company filings (10-Ks, investor reports)

-

Government trade databases (UN Comtrade, U.S. ITC)

-

Google Alerts and trusted industry news sites

-

Analyst research from firms like IBISWorld or Deloitte

Automated & Data-Driven Workflows

-

Use tools like Unwrangle to pull data from public catalogs, track price shifts, and monitor SKU-level availability from retailers like Home Depot, Ace Hardware, or Build.com

-

Plug into APIs for trade records, commodities, vendor databases, or global identifiers (UPC, GTIN)

-

Tap into procurement platforms like SAP Ariba or Coupa with built-in market insight modules

-

Monitor supplier risk through dashboards from Dun & Bradstreet, EcoVadis, or Prewave

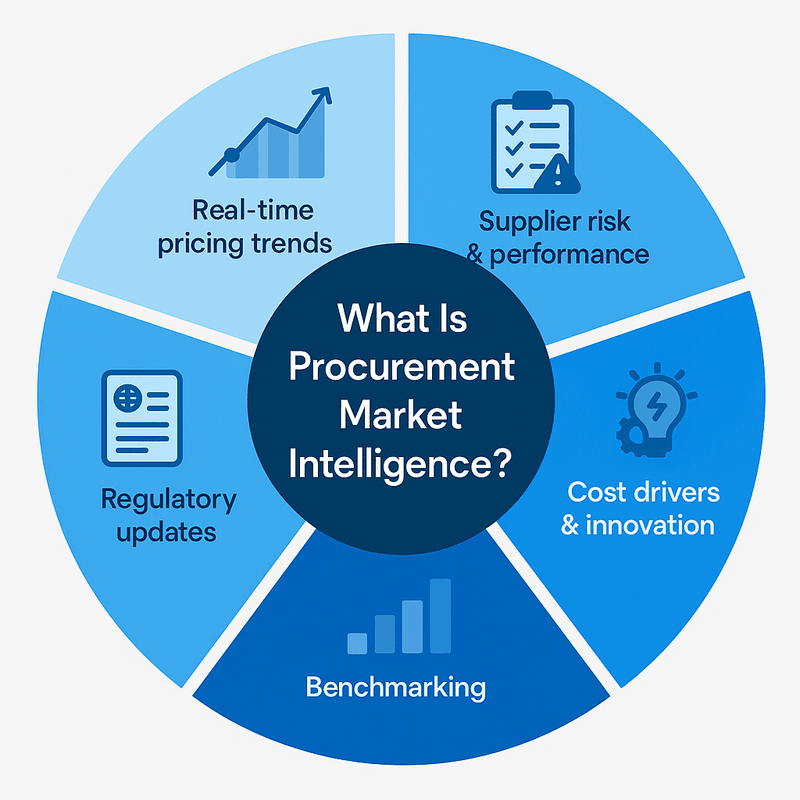

How Procurement Teams Actually Use Market Intelligence

Collecting data is one thing. Putting it to work is where the value really shows up.

Sourcing & Negotiation

Market data gives sourcing teams leverage. By tracking competitor pricing, supplier capacity, and key cost drivers, teams can make stronger RFP decisions and walk into negotiations with facts, not guesswork.

Risk monitoring

Disruptions rarely come with a warning. With supplier risk signals, regional alerts, and ESG data at your fingertips, you can detect issues early, before they impact your supply chain.

Cost forecasting

Partner with finance to build more accurate forecasts. Commodity trends and supplier performance insights help you anticipate shifts in total cost of ownership, not just react to them.

Competitive sourcing

Don’t source in a vacuum. Benchmark supplier terms, lead times, and minimums using live market data to ensure you’re always getting the best deal the market allows.

Building a Market Intelligence Strategy That Actually Works

Collecting market data is just the starting point. To make it count, procurement teams need a strategy that turns signals into action.

Here’s how to build that foundation:

Step 1: Define what you need to know

Don’t start by collecting everything. Start by asking better questions. Do you need visibility into supplier reliability? Commodity price shifts? Regional risk exposure? Clarifying your key priorities upfront keeps your efforts focused and impactful.

Step 2: Map the right data sources

Not all intel is created equal. Match your needs to the right sources, such as public filings, B2B marketplaces, trade databases, supplier catalogs, and competitor pricing. The goal isn’t more data. It’s better data that’s fit for purpose.

Step 3: Equip your team with the right tools

Manual collection doesn’t scale. Use scraping tools, APIs, and integrated procurement platforms to pull structured data quickly. Make sure your tools are flexible enough to plug into your current stack and grow with your data volume.

Step 4: Turn data into decisions

Collecting data is one thing. Making it actionable is another. Use analytics tools to identify patterns, compare vendors, flag outliers, and surface risks before they hit your operations.

Step 5: Monitor and adapt in real time

Market conditions shift fast. Build in continuous tracking so you’re not caught off guard. Real-time alerts, dashboards, and periodic reviews help you stay proactive, not reactive.

Final Thoughts

Procurement teams need more than historical data to make informed decisions. Market intelligence provides real-time visibility into supplier activity, pricing shifts, and emerging risks. They need information that can directly impact sourcing outcomes.

As more of this data becomes available online, web-based sources offer a practical way to supplement internal systems. The challenge is not access, but turning scattered signals into structured, usable information.

Tools like Unwrangle help this process by collecting and organizing procurement data without the overhead of building and maintaining scrapers in-house.

What matters is not just having data, but being able to act on it consistently. That requires a clear strategy, reliable sources, and the right infrastructure.